“This week, the prices of rare earth market products have been weakly adjusted, and the peak season order growth did not meet expectations. Traders have high activity, but downstream demand is not strong, and enterprise procurement enthusiasm is not high. Holders are cautious and watching, resulting in a deadlock in transactions. Recently, the State Council proposed to promote the high-quality development of the rare earth industry, and the Commerce Bureau issued a notice to strengthen rare earth export management, which may have a positive impact on rare earth prices. However, the short-term demand performance is weak, and prices will still be mainly weak and stable.”

Overview of Rare Earth Spot Market

This week, the prices of rare earth products have been weakly adjusted, and the circulation of compound products is sufficient. Separation companies are firm and stable in price, and currently the cost of oxide processing is relatively high. Scrap companies have limited supply and are reluctant to sell their goods, while some separation factories are seeking lower prices to replenish their goods. The overall willingness to ship is relatively low, mainly focusing on stabilizing prices.

The cold and desolate atmosphere in the rare earth spot market continues, with mainstream product prices continuing to decline, prices of praseodymium and neodymium maintaining volatility, and low activity of dysprosium and terbium. Metal manufacturers have a low willingness to lower prices, and at the same time, metal production costs are severely inverted, resulting in a shortage of spot goods. The magnetic material factory has reported that there are relatively few new orders received, with operating rates ranging from 70% to 80%. The growth of market orders is slow, and various enterprises are cautious in stocking, with limited short-term replenishment.

Overall, due to weak production costs and downstream demand, the price of praseodymium neodymium oxide will remain weak and stable, and the prices of dysprosium and terbium products will also continue to decline. However, recent rare earth related policies have been frequent, and the future price trend is expected to improve.

Mainstream product prices

| Table of Price Changes of Mainstream Rare Earth Products | |||||||

|

date product |

November 3 rd | November 6 th | November 7 th | November 8 th | November 9 th | variable quantity | average price |

| Neodymium praseodymium oxide | 51.15 | 51.64 | 51.34 | 51.23 | 51.18 | 0.03 | 51.31 |

| Metal praseodymium neodymium | 62.83 | 63.26 | 63.15 | 62.90 | 62.80 | -0.03 | 62.99 |

| dysprosium oxide | 264.38 | 264.25 | 263.88 | 263.25 | 262.25 | -2.13 | 263.60 |

| terbium oxide | 805.63 | 805.63 | 803.50 | 800.38 | 796.50 | -9.13 | 802.33 |

| praseodymium oxide | 52.39 | 52.39 | 52.35 | 52.35 | 52.35 | -0.04 | 52.37 |

| Gadolinium Oxide | 27.05 | 27.06 | 27.01 | 27.01 | 27.01 | -0.04 | 27.03 |

| holmium oxide | 57.63 | 57.63 | 56.56 | 56.31 | 55.14 | -2.49 | 56.65 |

| neodymia | 52.18 | 52.18 | 52.13 | 52.13 | 52.13 | -0.05 | 52.15 |

| Note: The above price units are all RMB 10,000/ton, all of which include tax. | |||||||

The price changes of mainstream rare earth products this week are shown in the figure above. As of Thursday, the quotation for praseodymium neodymium oxide was 511800 yuan/ton, an increase of 3300 yuan/ton compared to last Friday’s price; The quotation for metal praseodymium neodymium is 628000 yuan/ton, a decrease of 0300 yuan/ton compared to last Friday’s price; The quotation for dysprosium oxide is 2.6225 million yuan/ton, a decrease of 2.13 million yuan/ton compared to last Friday’s price; The quotation for terbium oxide is 7.965 million yuan/ton, a decrease of 91300 yuan/ton compared to last Friday’s price; The quotation for praseodymium oxide is 523500 yuan/ton, a decrease of 0400 yuan/ton compared to last Friday’s price; The quotation for gadolinium oxide is 270100 yuan/ton, a decrease of 0.0400 yuan/ton compared to last Friday’s price; The quotation for holmium oxide is 551400 yuan/ton, a decrease of 24900 yuan/ton compared to last Friday’s price; The quotation for neodymium oxide is 521300 yuan/ton, a decrease of 50000 yuan/ton compared to last Friday’s price.

Rare earth import and export data

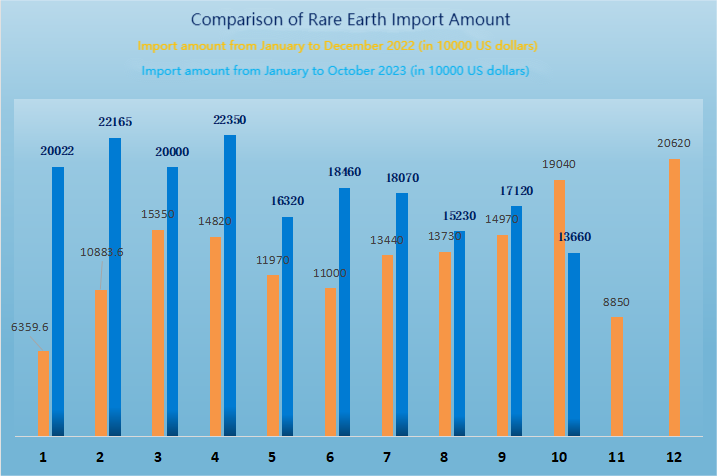

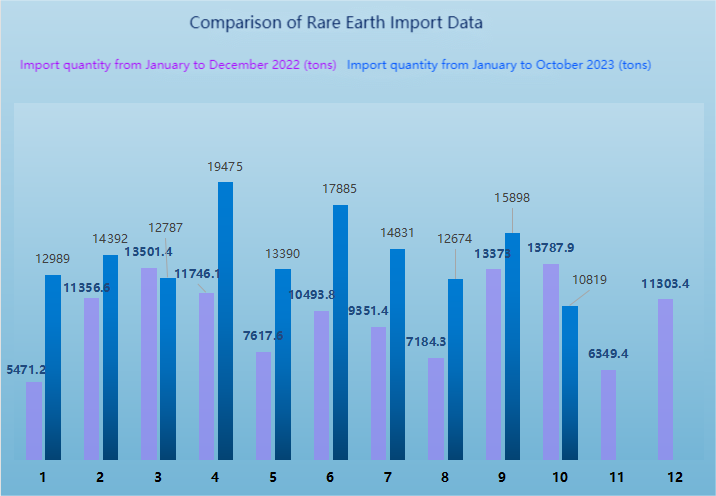

In October 2023, China imported 10818.7 tons of rare earths, a decrease of 31.9% month on month and 21.5% year-on-year, with an import value of 136.6 million US dollars. From January to October 2023, China imported a total of 145000 tons of rare earths, a year-on-year increase of 39.8%, with a total import value of 1.83 billion US dollars. The specific import situation is as follows:

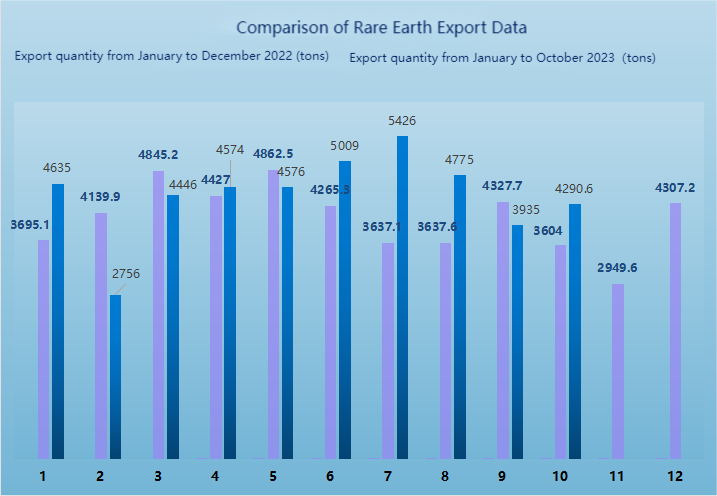

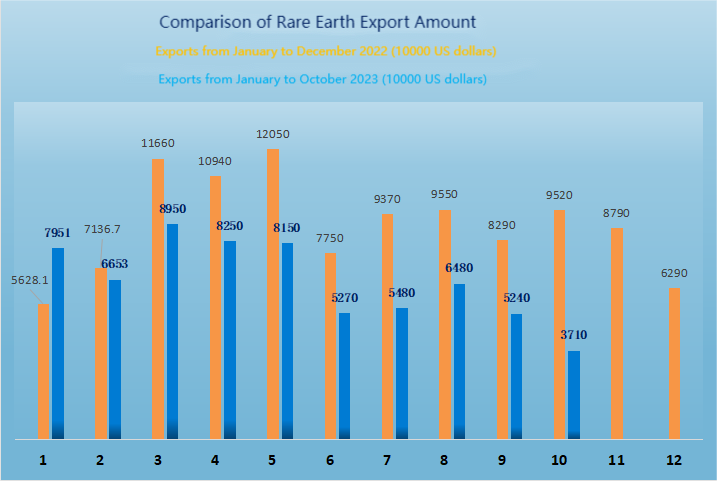

From January to December 2022, China exported a total of 49000 tons of rare earths and imported a total of 1.06 billion US dollars. In October 2023, China exported 4290.6 tons of rare earths, an increase of 9% month on month and 19.1% year-on-year, with an export value of 37.1 million US dollars. From January to October 2023, China exported a total of 44000 tons of rare earths, an increase of 7.7% year-on-year, with a total export value of 660 million US dollars. The specific export data is as follows:

Rapid development of humanoid robots with rare earth permanent magnets or potential growth points

With the continuous progress and innovative development of technology, humanoid robots have become an important development direction in the field of artificial intelligence. On November 2nd, the Ministry of Industry and Information Technology issued the “Guiding Opinions on the Innovative Development of Humanoid Robots”, which clearly proposed the development goals and timeline of the humanoid robot industry and planned to achieve mass production by 2025.

Nowadays, humanoid robots have made significant breakthroughs and innovations in visual recognition, language modeling, electric drive servo, and software and hardware design. Humanoid robots integrate advanced technologies such as artificial intelligence, high-end manufacturing, and new materials, and are expected to become disruptive products after computers, smartphones, and new energy vehicles. They have great development potential and broad application prospects, making them a new track for future industries.

Previously, Tesla announced that it would officially begin producing humanoid robots in 2023, becoming the largest driving force in driving global demand for high-performance neodymium iron boron magnetic materials, greatly changing its demand structure. Assuming that the demand for high-performance neodymium iron boron for a single humanoid robot is 3.5kg, it is expected that every 1 million humanoid robots will correspond to a demand of 3500 tons of high-performance neodymium iron boron. Conservatively estimated, the demand for high-performance neodymium iron boron for Tesla robots will reach 6150 tons by 2025.

At present, humanoid robots have been preliminarily applied in industries such as education, healthcare, and industry, and are expected to cover almost all downstream scenarios involving human operations in the future, replacing humans in labor-intensive and dangerous occupations. At present, “Robot+” has covered 206 categories of 65 industries. In order to innovate and develop a digital power and promote a new chapter of Chinese path to modernization, downstream demand of rare earth permanent magnet industry is expected to usher in new growth.

Recent Industry Information

1,On November 3rd, Li Qiang presided over a State Council executive meeting to study and promote the high-quality development of the rare earth industry. The meeting pointed out that rare earths are strategic mineral resources. We need to coordinate the exploration, development, utilization, and standardized management of rare earth resources, as well as various forces such as industry, academia, research, and application. We will actively promote the research and application of new generation green and efficient mining, selection, and smelting technologies, increase the research and industrialization process of high-end rare earth new materials, crack down on illegal mining, ecological destruction, and other behaviors, and focus on promoting the high-end, intelligent, and green development of the rare earth industry.

2,On November 7th, the Ministry of Commerce of the People’s Republic of China issued the “Statistical Investigation System for Import and Export Reports of Bulk Products”. The notice proposes to strengthen the management of rare earth exports and include rare earths subject to export license management in relevant catalogs.

Post time: Nov-13-2023